Money

20 Ways to Make Money with Google Gemini: Practical Methods Anyone Can Start

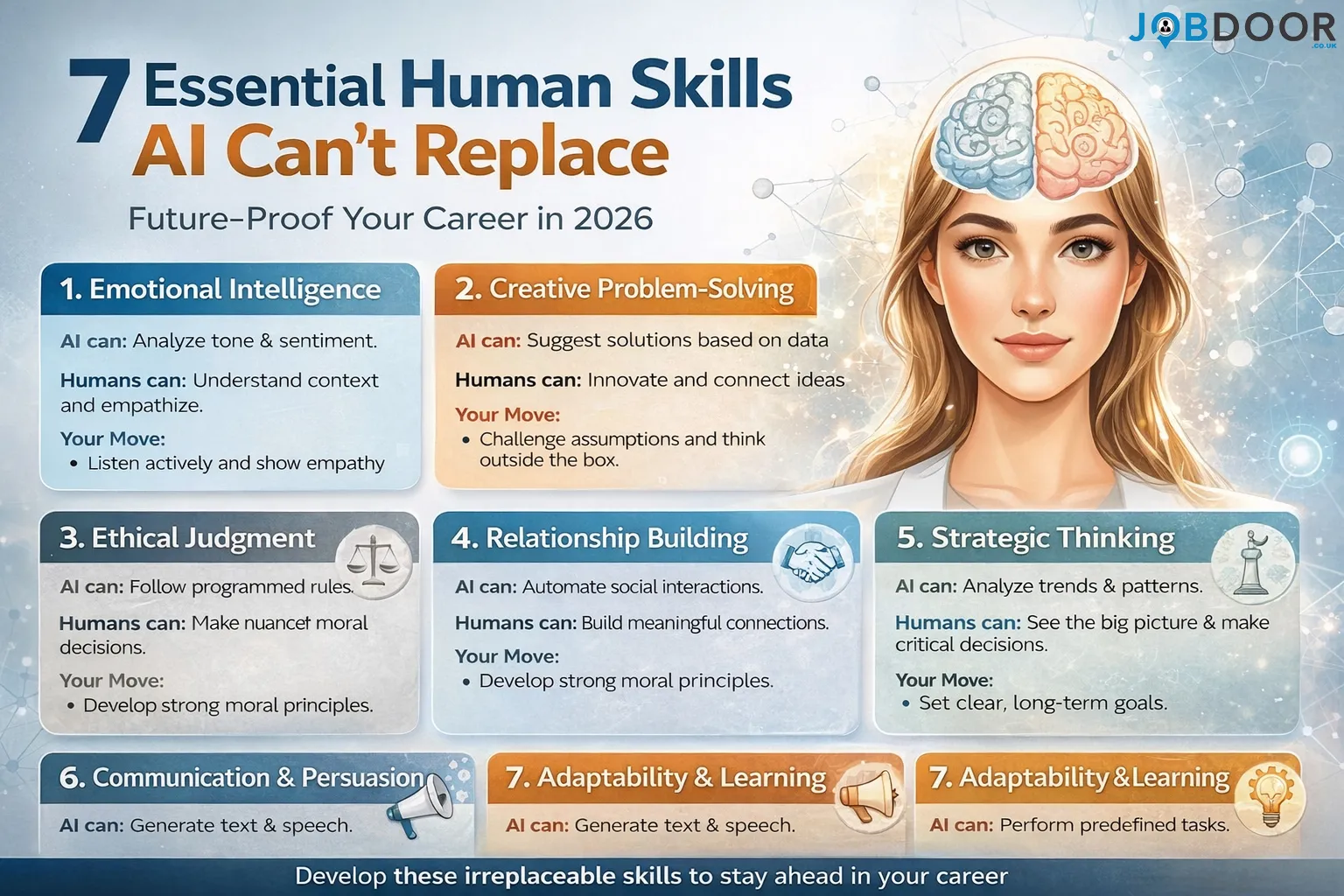

Artificial Intelligence is no longer limited to tech experts or large companies. Tools like Google Gemini are now accessible to everyday users, freelancers, creators, and business owners. The real opportunity is not simply using AI, but using it to create value that people are willing to pay for.

This guide explains 20 practical ways to make money with Google Gemini, focusing on skills, services, and systems that can generate income steadily. These methods are realistic, beginner-friendly, and suitable for long-term growth.

Why Google Gemini Is a Powerful Income Tool?

Google Gemini combines AI intelligence with Google’s ecosystem, making it especially useful for research, content creation, productivity, and automation. It helps users think faster, write better, analyze information, and solve problems efficiently.

The key is simple: AI does not replace people who use it wisely. Instead, it multiplies their output.

1. Freelance Content Writing:

Use Gemini to research topics, outline articles, and improve clarity. You still provide editing, originality, and structure, which clients value.

This works well for blogs, websites, newsletters, and business content.

2. SEO Content Services:

Gemini can help with keyword research ideas, content outlines, FAQs, and on-page optimization suggestions. Businesses constantly need SEO content to rank on Google.

If you understand SEO basics, Gemini becomes a powerful assistant.

3. Social Media Content Creation:

Create captions, post ideas, content calendars, and short-form text for brands. Many small businesses want consistent posting but lack time.

Gemini helps you work faster without sacrificing quality.

4. YouTube Script Writing:

Video creators need engaging scripts. Gemini can help with video outlines, hooks, and explanations while you refine tone and storytelling.

This service is in high demand and scales well.

5. Blogging for Passive Income:

Use Gemini to plan blog topics, research competitors, and structure long-form posts. Monetize blogs through ads, affiliate links, or digital products.

Blogging is slow at first, but it compounds over time.

6. Affiliate Marketing Content:

Gemini helps create product comparisons, reviews, and informational content. When paired with honest recommendations, affiliate content can generate recurring income.

Trust and consistency matter more than volume.

7. Resume and Cover Letter Services:

Job seekers need help presenting themselves. Gemini can assist with drafting resumes and cover letters, while you customize them professionally.

This is especially useful for freshers and career changers.

8. Online Course Creation:

If you have knowledge in any subject, Gemini helps structure lessons, write scripts, and create supporting material.

Courses can generate income repeatedly once published.

9. E-Book Writing:

Gemini can help outline, research, and draft e-books. You focus on editing, formatting, and positioning the book for a specific audience.

E-books work well for niches like business, self-improvement, and education.

10. Prompt Consulting and Templates:

Businesses often don’t know how to ask AI the right questions. You can create prompt templates for marketing, HR, sales, or productivity.

Well-tested prompts save time and deliver results.

11. Virtual Assistant Services:

Gemini helps with email drafting, scheduling ideas, summaries, and task organization. Virtual assistants are in constant demand.

Efficiency becomes your competitive advantage.

12. Market Research Services

Use Gemini to summarize trends, analyze competitors, and prepare reports. Startups and small businesses need research but can’t hire large teams.

Clear insights are more valuable than raw data.

13. Educational Content Creation:

Create study notes, simplified explanations, and practice material for students. Gemini helps explain complex topics clearly.

Education-related services have long-term demand.

14. Newsletter Writing:

Start a niche newsletter or write newsletters for businesses. Gemini helps plan topics, draft content, and maintain consistency.

Subscription-based newsletters provide predictable income.

15. Website Content Packages:

Many businesses need “About Us”, service pages, FAQs, and landing pages. Gemini helps structure these quickly.

You add customization, brand voice, and conversion focus.

16. Business Documentation Services:

Create SOPs, internal guides, onboarding documents, and training material. Gemini is excellent for structuring clear documentation.

This service is often overlooked but highly valuable.

17. Coaching and Consulting Support:

If you are a coach or consultant, Gemini helps prepare frameworks, worksheets, and session summaries.

It improves preparation and client experience.

18. Data Interpretation and Summaries:

Gemini can help explain charts, reports, and complex information in simple language. Many professionals need simplified insights.

Clarity saves decision-makers time.

19. Idea Validation Services:

Entrepreneurs often want feedback on ideas. Use Gemini to analyze markets, pros and cons, and risks, then present structured insights.

This works well for early-stage founders.

20. Building AI-Assisted Micro Businesses:

Combine multiple services into a small agency or digital business. Gemini helps with operations, marketing, content, and planning.

Systems create stability, not one-time tasks.

Common Mistakes to Avoid When Making Money With AI:

Relying entirely on AI without review

Copying output without originality

Ignoring ethics and accuracy

Chasing quick money instead of skills

AI works best when guided by human judgment.

How to Start Safely and Sustainably?

Start with one service

Practice before charging clients

Be transparent about AI assistance

Focus on delivering results

Long-term income comes from trust and consistency.

Final Thoughts:

Google Gemini is not a shortcut to instant wealth. It is a tool that rewards those who apply discipline, skills, and strategy. The real opportunity lies in combining AI efficiency with human thinking, ethics, and creativity.

If you focus on solving real problems, improving quality, and building systems, Gemini can help you create income streams that grow over time.

The question is not whether AI will change work. The question is, will you use it to your advantage or watch others do so?

Money

5 Free Sites to Sell Digital Products and Keep More Profits

If you’ve ever thought about selling digital products but stopped halfway, you’re not alone.

Maybe you asked yourself:

- “Is this even worth it?”

- “I’m not a tech person… what if I mess it up?”

- “Everyone else seems ahead. I’m already late.”

Take a breath.

Selling digital products is not complicated, not risky, and not only for experts. In fact, it’s one of the simplest ways today to earn online—if you start the right way.

This guide is written for complete beginners. No experience. No paid tools. No pressure.

By the end of this post, you will:

- Understand what digital products really are

- Change your mindset around selling online

- Learn 5 free sites where you can sell digital products and keep more profits

- Know exactly what to do next, step by step

- Learn how to track what’s working without stress

Let’s start simple. One clear step at a time.

What Are Digital Products?

A digital product is something you create once and sell many times—online.

No packaging.

No delivery truck.

No inventory.

Examples include:

- Ebooks or short guides (PDFs)

- Notion templates

- Resume templates

- Canva designs

- Study notes

- Planners or journals

- Stock photos or digital art

- Online courses or video lessons

Once created, a digital product can earn money even while you sleep.

Sounds good, right? But here’s the truth most people don’t tell you…

The Mindset Shift You Must Make (Before Picking Any Platform):

Most beginners fail not because of platforms, but because of mindset.

Common Wrong Beliefs:

- “My product must be perfect.”

- “People won’t buy from me.”

- “I need a website first.”

- “I need to be an expert.”

None of this is true.

The Right Mindset:

- Simple beats perfect

- Helpful beats fancy

- Started beats stuck

Your first digital product is not your final product.

It’s your starting point.

Think of it like learning to ride a bicycle.

You don’t wait until you’re perfect.

You start. You wobble. You improve.

Now let’s talk about where to sell.

Why Choosing the Right Free Platform Matters?

As a beginner, you need platforms that:

- Are free to start

- Handle payments for you

- Are easy to use

- Don’t eat up all your profits

Good news? These platforms already exist.

Below are the 5 best free sites to sell digital products, especially if you’re just starting.

1. Gumroad:

Gumroad is one of the easiest platforms to sell digital products online.

You upload your product.

Set a price.

Share the link.

That’s it.

What You Can Sell on Gumroad?

- Ebooks

- Templates

- Music

- Videos

- Courses

- Any downloadable file

Key Benefits:

- No monthly fees

- Handles payments and file delivery

- Works worldwide

- Clean and simple dashboard

Downsides:

- Small transaction fee per sale

- Limited customization

Best For

Complete beginners who want to sell digital products fast without tech stress.

2. Payhip:

Payhip is similar to Gumroad but gives you more flexibility.

What Makes Payhip Special?

- You can create a full storefront

- Supports coupons and discounts

- Built-in VAT and tax handling

- Free plan available

What You Can Sell?

- Digital downloads

- Online courses

- Memberships

Key Benefits:

- Free to start

- Better branding than Gumroad

- Email updates to customers

Downsides:

- Transaction fees on free plan

- Slight learning curve (still beginner-friendly)

Best For

Creators who want more control without paying upfront.

3. Ko-fi:

Ko-fi started as a “buy me a coffee” platform, but now it’s powerful for digital products.

Why Ko-fi Works Well?

- Very friendly and personal

- Supporters can tip you

- You can sell downloads directly

- Optional memberships

What You Can Sell?

- Digital art

- PDFs

- Templates

- Exclusive content

Key Benefits:

- No platform fee on free plan (only payment processor fees)

- Feels personal, not salesy

- Great for social media creators

Downsides:

- Not ideal for large catalogs

- Less marketing tools

Best For

Artists, writers, and creators with a small but loyal audience.

4. Etsy:

Many people think Etsy is only for physical items. That’s wrong.

Etsy is huge for digital products.

What Sells Well on Etsy?

- Planners

- Printables

- Templates

- Wall art

- Study notes

- Wedding invites

Why Etsy Is Powerful?

- Millions of buyers already searching

- Built-in trust

- SEO-driven marketplace

Costs to Know:

- Small listing fee

- Transaction fee per sale

Key Benefits:

- You don’t need an audience

- Buyers already exist

- Strong search visibility

Downsides:

- Competitive

- Fees add up over time

Best For

Beginners who want organic traffic without social media.

5. Google Drive + Payment Link:

This is the simplest system most people ignore.

How It Works?

- Upload your digital product to Google Drive

- Set access to “view only”

- Create a payment link (UPI, PayPal, Stripe, Razorpay)

- After payment, share the Drive link

Why This Works?

- 100% free

- Full control

- No platform dependency

Downsides:

- Manual delivery

- Not scalable

Best For

Testing your first digital product or selling within WhatsApp, Instagram, or Telegram.

How to Choose the Right Platform for You?

Ask yourself:

- Do I want speed? → Gumroad

- Do I want branding? → Payhip

- Do I have fans? → Ko-fi

- Do I want search traffic? → Etsy

- Do I want full control? → Google Drive

Start with one platform only.

Don’t overthink.

Step-by-Step: Your First Digital Product Plan:

Step 1: Pick One Simple Product

Examples:

- “30-page exam notes”

- “Instagram caption templates”

- “Resume format for freshers”

Step 2: Create It (Keep It Simple)

- Use Google Docs or Canva

- Focus on usefulness, not beauty

Step 3: Choose One Free Site

Don’t compare endlessly. Pick one and move forward.

Step 4: Upload and Price It

Start small:

- $9

- $50

- $99

- $199

Low price = less fear for buyers.

Step 5: Share It

- WhatsApp groups

- Instagram bio

- Telegram channels

- College groups

Tracking Your Success (Without Feeling Overwhelmed):

You don’t need analytics tools.

Just track:

- How many people clicked

- How many people bought

- What questions people ask

Use a simple notebook or Google Sheet.

Progress beats perfection.

Common Mistakes Beginners Should Avoid:

- Creating 10 products before selling 1

- Waiting for the “right time”

- Copying others blindly

- Giving up too early

Remember:

Every successful seller started with zero sales.

Final Thoughts: Start Today, Not Someday:

Selling digital products is one of the most practical ways to build income today.

You don’t need:

- A big audience

- Technical skills

- Money to start

You only need:

- One idea

- One free platform

- One small step today

Choose one site from this list.

Create one simple digital product.

Upload it today.

Your first sale might take time.

But it will come.

And when it does, everything changes.

Start now. Your future self will thank you.

Money

Spend Like Rich People: Are You Building Wealth or Just Looking Wealthy

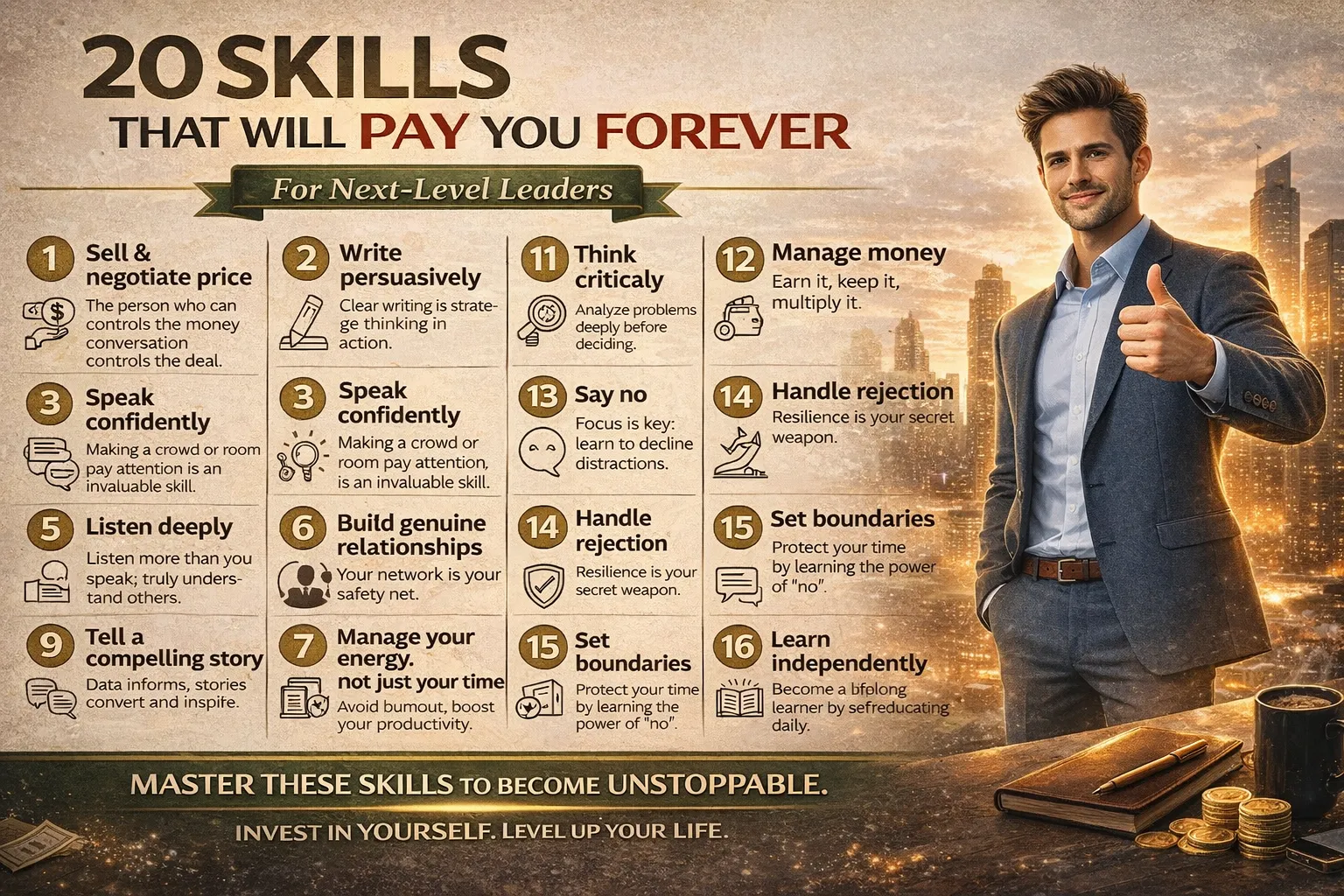

Most people believe wealth is about how much money you earn. In reality, wealth is built by how you spend the money you already have. The image you shared highlights a powerful contrast between broke spending habits and rich spending habits. It raises an important question: are you spending to impress others, or are you spending to secure your future?

Rich people and broke people often earn similar incomes at some stage of life. The difference is not income alone, but financial behavior and mindset. Understanding this difference can completely change your financial direction.

Why Spending Habits Matter More Than Income?

You can earn more money and still remain broke if your spending habits are poor. On the other hand, many wealthy individuals built their fortunes slowly by controlling expenses and making intentional choices.

Money is a tool. The question is, are you using it to build assets or to fund temporary pleasure?

How Broke People Spend Money?

Broke spending is not about income level. It is about decisions made without long-term thinking. The image highlights common areas where extra money is often wasted.

Shopping at the mall becomes an emotional activity rather than a need-based one. Buying things for instant satisfaction drains money without creating lasting value.

Fancy restaurants and frequent eating out may feel rewarding, but they often consume a large portion of disposable income. These experiences fade quickly, but the money is gone permanently.

Night out drinking and frequent partying feel harmless, but over time they quietly destroy savings. Small expenses repeated often can cause major financial damage.

New gadgets and televisions are another trap. Technology depreciates fast. Buying the latest device does not increase wealth, but it often delays financial progress.

Ask yourself honestly, how much of your money disappears into things that add no future value?

How Rich People Spend Money Differently?

Rich people are not careless spenders. They are intentional. They think beyond today and focus on tomorrow.

Instead of shopping for status, they invest in stocks and businesses that generate future income. Every rupee or dollar spent is expected to return more value later.

They buy assets rather than liabilities. Assets put money back into their pocket. Liabilities take money out. This simple principle guides most wealthy decisions.

Self-education and personal growth are major priorities. Rich people spend on books, courses, skills, and mentorship. Why? Because skills increase earning potential for life.

They also invest in networking events. Meeting the right people often creates opportunities that money alone cannot buy. Relationships compound just like investments.

Do you see the pattern? Rich people spend to grow, not to show.

Looking Rich vs Being Rich:

One of the biggest financial mistakes is confusing appearance with reality. Looking rich means expensive clothes, gadgets, cars, and lifestyle. Being rich means owning assets, having savings, and enjoying financial peace.

Looking rich impresses strangers. Being rich protects your family.

Which one do you want?

Why Buying Assets Changes Everything?

Assets work for you while you sleep. Stocks, businesses, rental properties, and skills create income streams. They reduce dependence on a single salary.

When rich people get extra money, they ask a simple question: will this purchase help me earn more or become smarter?

If the answer is no, they think twice.

The Role of Self-Education in Wealth Building:

Education does not stop after school. Rich people understand that learning never ends. They invest in knowledge because it compounds faster than money.

Skills such as investing, communication, leadership, and problem-solving increase income opportunities across decades.

Are you spending more on entertainment or education?

Networking Is Not Socializing:

Many people misunderstand networking. It is not about parties or showing off. It is about exchanging ideas, building trust, and finding opportunities.

Rich people spend time and money in environments where growth happens. They surround themselves with people who challenge their thinking and push them forward.

Who do you spend most of your time with?

Spending Wisely Does Not Mean Living Poorly:

Spending like rich people does not mean living a boring or restricted life. It means choosing wisely. It means delaying some pleasures to enjoy greater freedom later.

Rich people still enjoy life. They just don’t sacrifice their future for temporary excitement.

Would you rather enjoy one expensive night or enjoy financial freedom for years?

Small Spending Decisions Create Big Outcomes:

Financial habits work silently. Small wasteful expenses repeated daily create long-term damage. Small smart investments repeated consistently create wealth.

The difference is not dramatic at first. Over time, it becomes life-changing.

Are your daily money habits moving you forward or holding you back?

How to Start Spending Like Rich People Today?

Track where your money goes every month

Cut expenses that don’t add long-term value

Invest in assets before upgrading lifestyle

Prioritize learning and skill-building

Build savings before luxury purchases

You don’t need to be rich to start spending like rich people. You need discipline and clarity.

Common Mistakes to Avoid:

Buying things to impress others

Confusing income growth with wealth growth

Ignoring small expenses

Avoiding investments due to fear

Delaying financial education

Mistakes repeated long enough become habits. Habits shape outcomes.

Final Thoughts:

Wealth is not built by chance. It is built by choices made consistently over time. The way you spend money today determines the options you have tomorrow.

Money

26 Lucrative Passive Income Ideas to Build Wealth in 2026

Building wealth has always relied on one simple principle: earning money even when you are not actively working. For generations, people have used dividends, rental income, bonds, and businesses to create financial stability. In 2026, the idea of passive income remains the same—but the opportunities have expanded.

This guide explores 30 lucrative passive income ideas that can help you unlock financial freedom through diversified income streams. These ideas range from traditional investments to modern digital opportunities, allowing you to choose what suits your capital, skills, and risk tolerance.

What Is Passive Income (and What It Is Not)

Passive income is money earned with limited ongoing effort after the initial setup. It does not mean “no work at all.” Most passive income streams require:

- Time or money upfront

- Proper planning

- Periodic maintenance

The goal is not quick profits, but consistent, repeatable income over time.

1. Dividend-Paying Stocks

Dividend stocks pay shareholders a portion of company profits regularly. This is one of the oldest and most reliable passive income methods.

Best for: Long-term investors seeking steady income

Risk level: Low to moderate

2. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission on each sale made through your referral link.

Best for: Bloggers, content creators, niche website owners

Key factor: Trust and quality content

3. Social Property Investment

Investing in shared or fractional real estate allows you to earn rental income without owning entire properties.

Best for: Investors with limited capital

Advantage: Lower entry cost than full ownership

4. Rental Property

Owning rental property provides monthly cash flow and long-term appreciation. It remains one of the most proven wealth-building tools.

Best for: Investors with capital and patience

Important: Location and tenant management

5. REITs (Real Estate Investment Trusts)

REITs allow you to invest in real estate without managing properties. They pay regular dividends.

Best for: Hands-off real estate exposure

Liquidity: Easier to buy and sell than property

6. Bonds and Fixed-Income Securities

Government and corporate bonds provide predictable interest income.

Best for: Conservative investors

Purpose: Stability and capital preservation

7. Peer-to-Peer Lending

P2P lending platforms allow you to lend money and earn interest.

Best for: Investors seeking higher returns

Risk: Depends on borrower quality

8. Digital Products

Selling ebooks, templates, stock photos, or design assets can generate ongoing income.

Best for: Creators and professionals

Benefit: High margins and scalability

9. Online Courses

Once created, an online course can generate income repeatedly with minimal upkeep.

Best for: Experts, teachers, professionals

Key: Quality content and clear outcomes

10. Selling Print-on-Demand Products

Design once, sell repeatedly—without inventory management.

Best for: Designers and niche marketers

Platforms: POD marketplaces

11. Storage Units

Storage facilities offer steady income with relatively low maintenance.

Best for: Property investors

Advantage: Less tenant-related issues

12. ATM Business

Owning ATMs in high-traffic locations generates passive transaction fees.

Best for: Investors with initial capital

Key: Strategic placement

13. Rental Equipment

Renting tools, machinery, or event equipment can create recurring income.

Best for: Local entrepreneurs

Tip: Focus on high-demand items

14. High-Interest Savings Accounts

While returns are modest, savings accounts offer risk-free passive income.

Best for: Emergency funds

Purpose: Capital safety

15. Index Funds

Index funds track the market and offer long-term growth with dividends.

Best for: Long-term investors

Advantage: Low fees and diversification

16. Licensing Creative Work

Music, photography, designs, and illustrations can earn royalties over time.

Best for: Artists and creatives

Benefit: Ongoing income from one-time work

17. Mobile App Ownership

Apps with ads or subscriptions can earn passive income once launched.

Best for: Developers or investors

Challenge: Initial development

18. YouTube Automation Channels

Well-structured channels can generate ad revenue over time.

Best for: Content planners

Key: Consistency and niche focus

19. Blog Monetization

Blogs earn through ads, affiliates, and sponsored content.

Best for: Writers and niche experts

Time frame: Long-term

20. Dropshipping Stores

Automated stores can generate sales with minimal inventory handling.

Best for: Digital entrepreneurs

Important: Product selection

21. Subscription-Based Newsletters

Paid newsletters generate recurring monthly income.

Best for: Writers and analysts

Focus: Valuable insights

22. Vending Machines

Like ATMs, vending machines earn small but steady income.

Best for: Local business owners

Key: Location

23. Royalties from Books

Self-published books earn income long after release.

Best for: Writers and educators

Advantage: Ownership and control

24. Stock Photography

Photos uploaded once can sell repeatedly.

Best for: Photographers

Tip: Focus on evergreen themes

25. Franchise Ownership

Some franchises require minimal daily involvement.

Best for: Investors

Requirement: Capital and due diligence

26. Rental Lodges and Vacation Homes

Short-term rentals offer higher income potential.

Best for: Property owners

Risk: Seasonal demand

27. Digital Membership Communities

Paid communities generate recurring revenue.

Best for: Coaches and educators

Key: Engagement

28. Crypto Staking (High Risk)

Staking earns rewards for holding assets.

Best for: Experienced investors

Warning: Volatility

29. Intellectual Property Rights

Patents and trademarks can generate licensing fees.

Best for: Innovators

Time frame: Long-term

30. Automated E-Commerce Stores

Well-optimized stores can run with minimal oversight.

Best for: Experienced sellers

Focus: Systems and automation

How to Choose the Right Passive Income Idea

Ask yourself:

- How much capital can I invest?

- How much risk can I tolerate?

- Am I seeking cash flow or long-term growth?

- Can I commit upfront time?

Avoid chasing trends. Sustainable wealth is built patiently.

Final Thoughts

Passive income is not about shortcuts. It is about building assets that work for you over time. The most successful individuals combine:

- Traditional financial wisdom

- Modern opportunities

- Discipline and consistency

By choosing the right mix of these 30 passive income ideas, you can start building wealth today and move steadily toward financial freedom in 2026 and beyond.

If you want, I can:

- Optimize this article for kmrinside.in

- Add SEO keywords, FAQs, and schema

- Convert it into Pinterest or Instagram carousel content

- Create internal linking with related posts

Just tell me what you’d like next.

-

Career2 years ago

Career2 years agoCareer Opportunities for Seniors: 7 Jobs that are Perfect for Older Adults

-

Job Description2 years ago

Job Description2 years agoGraphic Designer Job Description: Education, Salary, Skills, Work Hours

-

News2 years ago

News2 years agoStudents’ question to UK PM Rishi Sunak: “What if your kids started smoking?

-

Career2 years ago

Career2 years ago13 Best Jobs That AI Can’t Replace: A Guide to Future-proof Careers

-

Career2 years ago

Career2 years agoStandard Employment Contract Template Example for UK (Word & PDF)

-

Money2 years ago

Money2 years agoHow To Get Paid to Read Books? (9 Best & Legit Sites)

-

Job Description2 years ago

Job Description2 years agoSupport Worker Job Description: Qualifications, Skills, Salary, Working Hours

-

News2 years ago

News2 years agoTop 10 Richest Countries in 2024 By GDP Per Capita